Risk Management is the key to successful trading! I’m sure you heard this part so many times, but more often, new traders overlook this part and try to just place the next trade. So, I’m going to explain everything you need to know and understand when we talk about Risk Management in this miniature guide.

Why Do You Need To Pay Attention To Your Risk Management?

The Key Risk Factors To Understand

When talking about Risk Management, we have many things that we can cover: Today, I just want to give you an overview of the most important things you need to know and have in your plan.

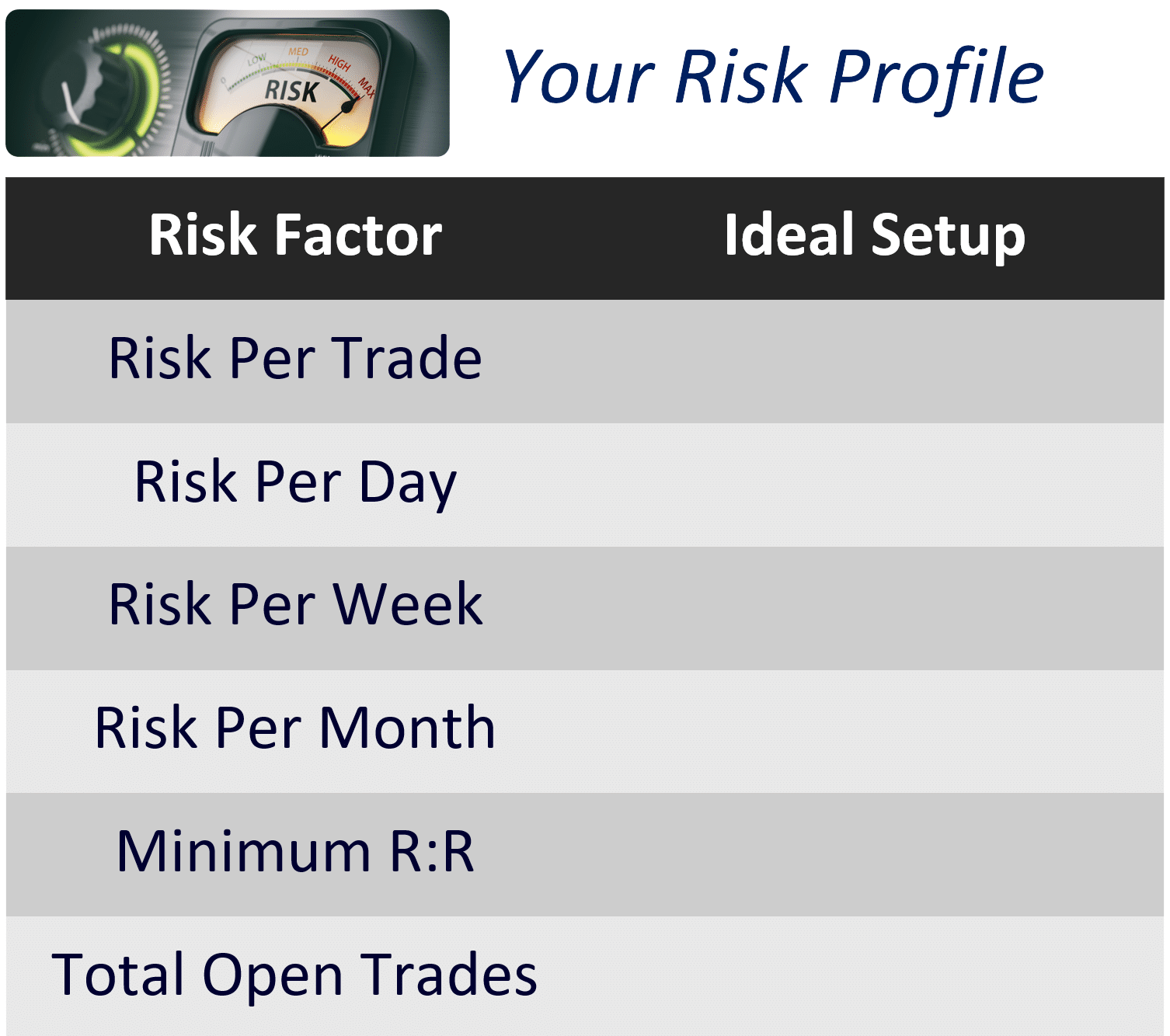

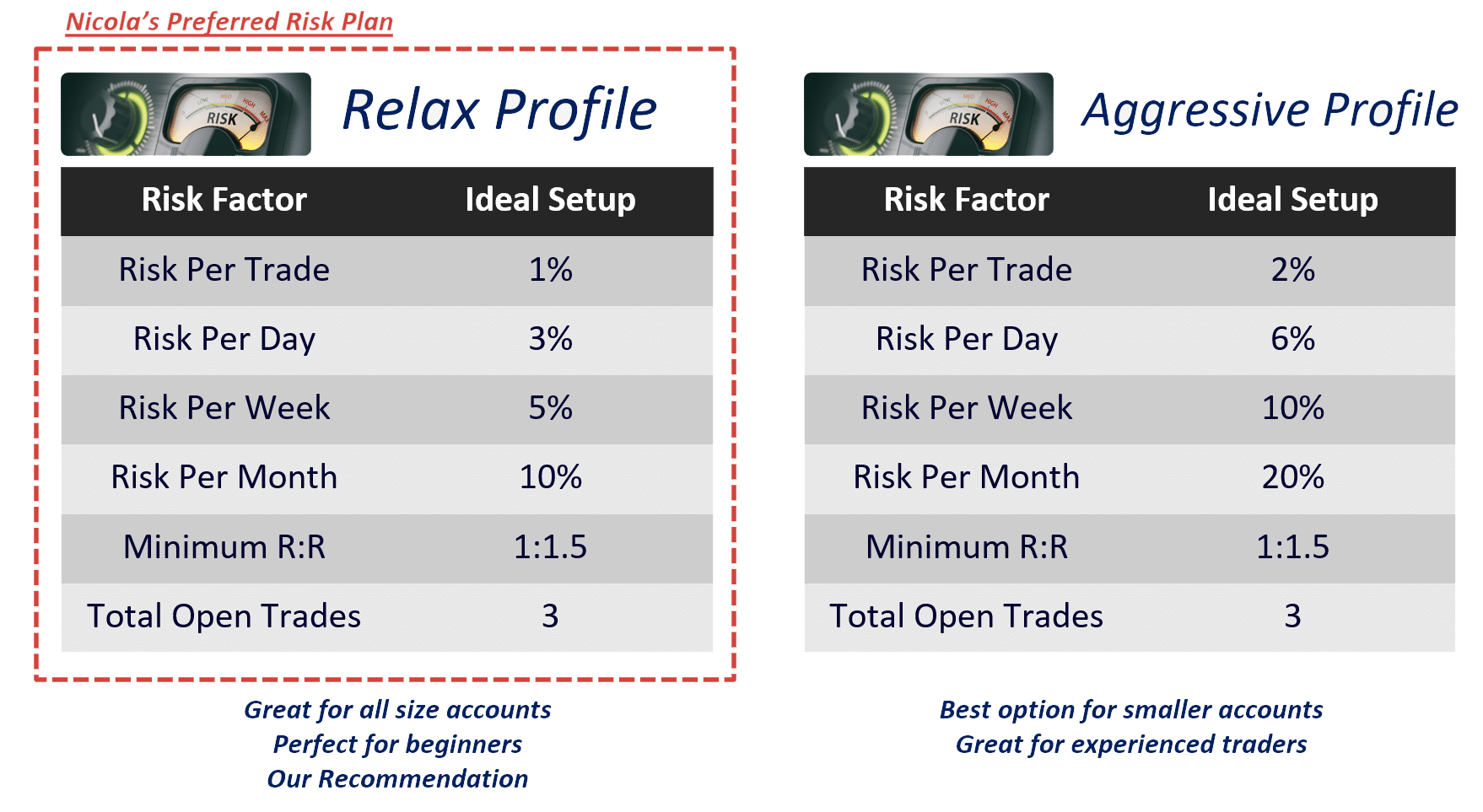

Risk Per Trade (RPT) – For each trader, risk should be the same and in %. The suggested range should be between 0.5-2%, depending on the account size and how well you know the strategy. Once you define this level for yourself, it’s going to be easy to calculate lot size.

Risk Per Day (RPD) – We must have a maximum allowed drawdown for each trading day. The suggested range should be between 1.5-4%. You can quickly recover from this kind of loss, so it’s better just to stop trading till the end of a day if you reach your RPD number. This helps you keep from revenge trading, cool down till tomorrow, and just start trading again. The market won’t disappear overnight.

Risk Per Week (RPW) – This is the same idea as we have for RPD, only on a weekly scale. Suggested range around 4-8%, again not some crazy number. So even if you reach it, you won’t feel pressure just to get to break even next week. If you reach this level, stop trading till the following Monday. Don’t look at the charts at all. Go back to education and practice, just don’t trade.

Risk Per Month (RPM) – The final drawdown you should worry about is your monthly risk. The suggested range is between 10-15% (maybe 20% on smaller accounts, but I wouldn’t suggest it for a start). The same idea as before: if you reach it, stop trading till the end of the current month and go back on education.

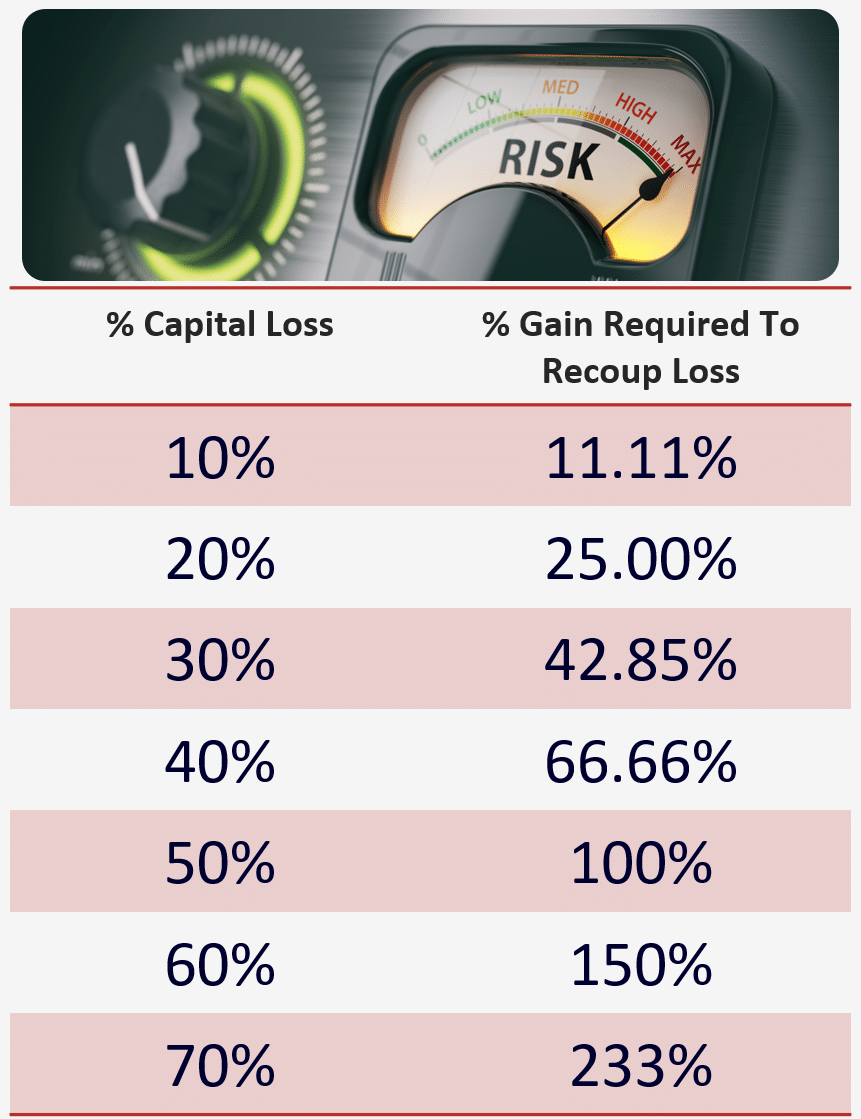

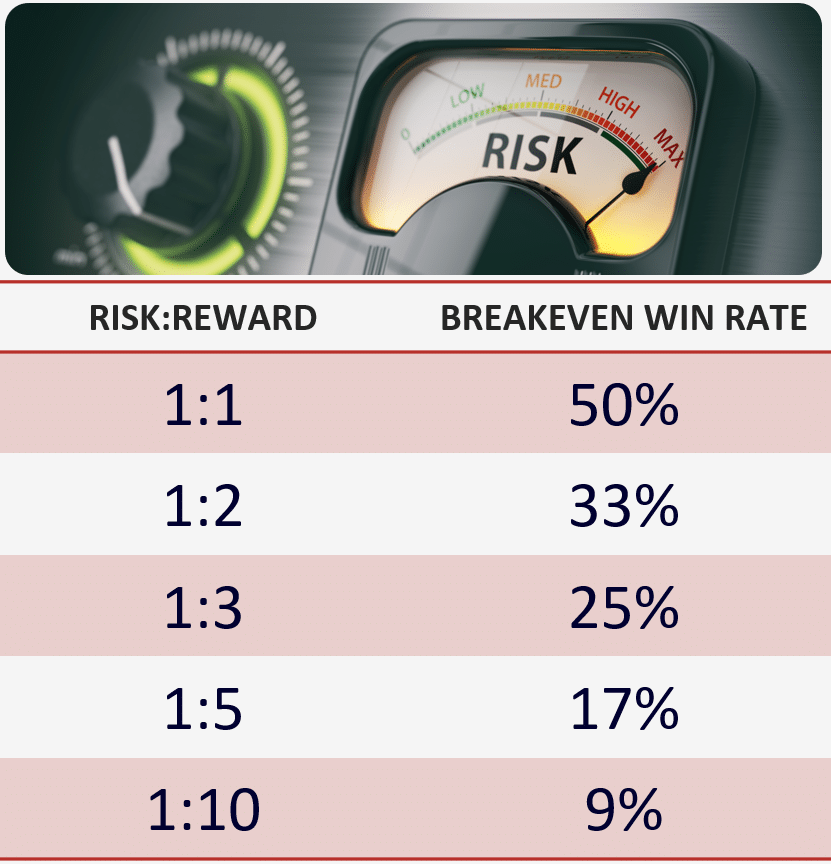

Risk: Reward – It’s not the same If you are risking $100 to make $100 and risking $100 to make $300. You should always figure out what the minimum accepted RR level is that you want to take. This is all personal choice, but I’ll drop you the win rate calculation to help you with this.

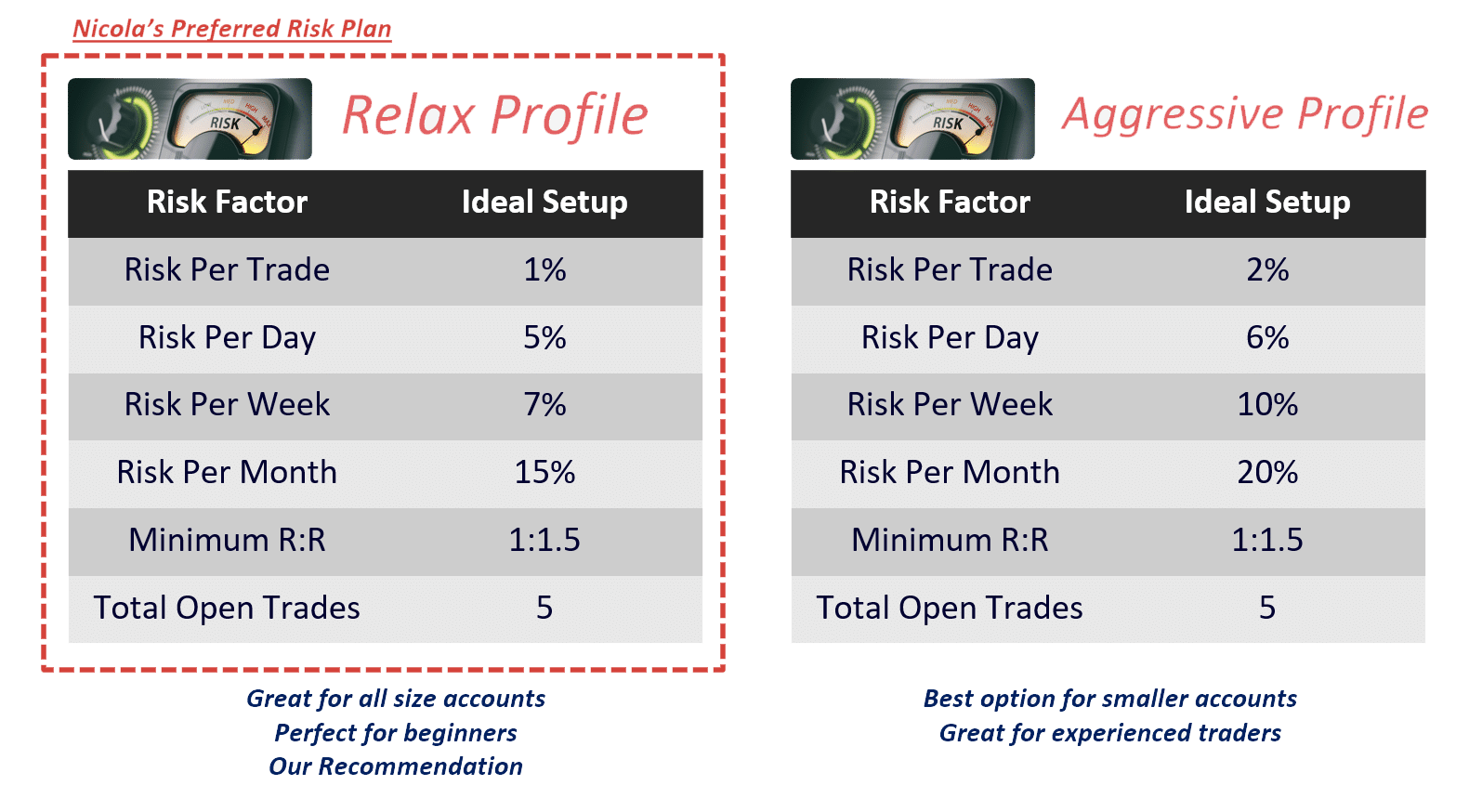

The Best Way To Make Your Risk Plan

An Aggressive Risk Profile

On the image above, you can see the Aggressive Risk Factors that I use for day trading Forex. You can stick with this or change numbers according to your style.

Conservative Risk Profile

In my experience, swing traders usually have a great conservative approach to Risk Management. Keep in mind the profile I’ll include below has a little bit more RPD-RPW, just to make sure we can hold more open positions. If you want, add another thing to your list, like Maximum Open Positions to help you with this.

Quick Plan For Tracking & Changing Your Risk Profile

Your Risk Profile can be done once, and that’s all. But I believe that, like anything else, we should always try to track and improve. The more data that we have, the easier it will be to change our risk factors.

Before you change anything, make sure that you have a minimum of 50 (the ideal number would be 100) trades, so you have some data to research. When you start checking your trades, the first thing you can do is your Win Rate to get an idea of what type of trades you need. Let’s say you have a 50% Win Rate. If that’s the case, your Risk Reward shouldn’t be less than 1:2 if you want to be profitable.

Conclusion

Taking care of your account is the highest priority for any trader. You should now be able to understand everything you need to have and monitor towards your path of success. Just make sure to spend some time developing the numbers that are going to work for you, and that’s all you need.

The majority of the risk management can be automated in some ways, but we will have a good discussion about that part soon.

thank you nicola this has been very informative and helped me a lot with my risk management

Hi Rakesh, I’m glad that you learned something from me. Keep the good work.