Trading Millions of Dollars is the dream of the majority of traders! Today we will focus on how any retail trader can get funding and earn an extra 5-10k per month by doing the same things they are doing now. Most traders think you need to work for a hedge fund or other institution to access significant capital, but that is wrong. Right now, you can get a quick 1M to trade in the next 30-60 days with proprietary trading funds. Yes, Prop trading is still here, and it’s one of the best ways to move your trading to the next level. Let me guide you step by step on succeeding with prop trading.

Step #1 Understand What Prop Trading Is?

What is proprietary trading? Simply put, it’s when a bank or other financial institution trades stocks, derivatives, bonds, commodities, or any other financial instruments in its own account. This differs from the way banks usually do business – by processing trades for clients and earning commissions on those transactions. When a bank engages in prop trading, it makes excess profits. This gives them an edge over the average investor who may not have access to the same level of market information.

In the last ten years, funds that have extra capital and do not know where to invest figured out that they can earn more if the money they do not trade is given to retail traders with a good track record. This way, funds get money invested in the market and traded.

So for you, what’s important to understand is that we have a lot of companies now that offer extra capital to traders and that it’s easier than ever to get 1m in a trading account in the next 30-60 days.

Step #2 What’s The Pros & Cons Of Prop Trading?

Trading for Prop Firms can be great. In my opinion, it’s a much better approach when compared to working for other people and building your own fund. Not everything is perfect though, and now it’s time for us to go over the pros and cons that you must be aware of before starting this journey.

We are going to start with PROS.

Pro #1 Get Funded Fast

From the time you start your application till the moment you get your real trading account, it will take between 20-30 days! This is more than enough time to raise your capital and prepare your “Game Plan.” For me, this is one of the biggest pros to using this kind of help, since if you have a small account and dream about trading larger amounts, this will dramatically decrease the time it takes.

Pro #2 Strict Rules for Better Discipline

Every prop firm will have a set of rules that you need to follow, not all of them are ideal for someone who wants to earn a quick profit, but if you are here because you want to succeed and not get rich in one month, this should be your plus! The rules that you will get are going to match 99.99% of the rules you need to follow if you work in a hedge fund or any other institution, and following strict rules will make you a better trader in general.

Most traders, when they trade their capital, do not care much about simple rules. Here, you are forced to follow them, so it’s going to come naturally when you return to trading on your account later on.

Pro #3 Easy Way To Get 1M

The job of the Prop is to find quality traders and keep them as happy as possible. When you’re starting this kind of journey, usually, you get accounts between 25-100k to start, but after a few months, if you prove that you can achieve consistent results, you will get larger and larger account sizes. The majority of companies will tell you that 1M is the most they will give you, but the reality told me something different. After working with every Prop in the world, you get a call after 6-8 months, and they increase you to 10M. Defiantly the biggest pro in my book.

Pro #4 Trade on Your Time

Trading, in general, gives you the ability to work whenever you want. A Prop Fund is no different. You are in control, and they will not tell you when to trade. That part is all you! I suggest that you keep trading the same time that has been working for you, and you are good to go. You can feel some pressure at the start since it’s new, and you may want to trade more, don’t do it. Keep doing what you have done till now, and you are going to kill it.

We talked about some positive parts when trading with a Prop Fund, and now let’s go over the cons and check out some things I hate in this industry.

Con #1 Forced To Trade on Their Platform

Every trader has their own platform of choice when we talk about trading. For some people, that is trade station, ninja trader, meta trader, or whatever, and in 95% of cases, you will get stuck with a platform you do not like. The majority of the prop funds in 2022 offer MT4 or MT5, and to me, this is a big downside, but it’s acceptable.

Con #2 Passing Audition

We have mentioned before that it will take some time to get funding from a Prop Fund. Usually, they will call this stage the Audition Period, where you have to prove to them you deserve more capital to trade. I am putting this as a con, because this will be different from Prop to prop. Let us check a few options to get a full picture of how that looks.

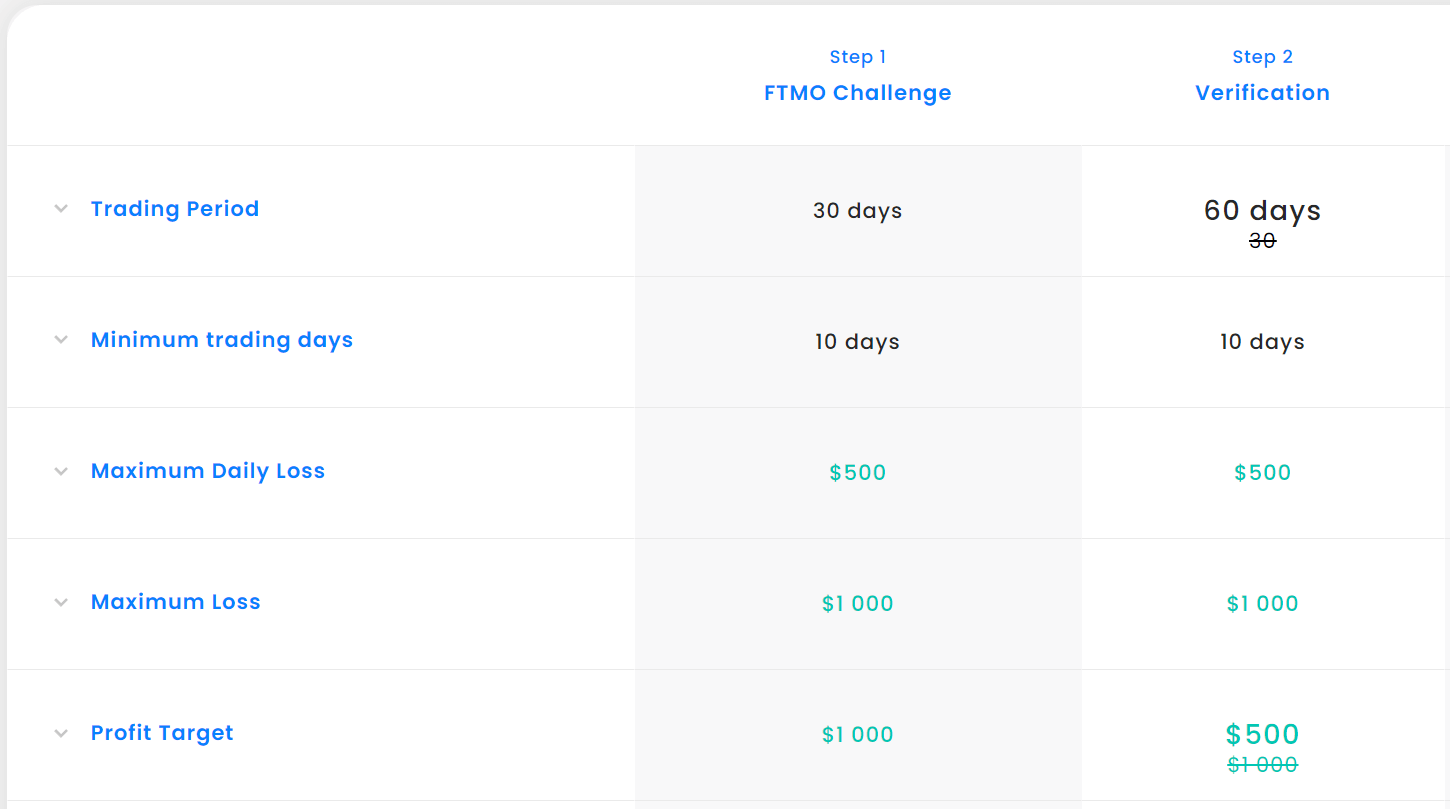

Example FTMO

This tells you that you need to earn a 10% return for two months, with a trading minimum of 10 days, max risk per Day is 5%, and max loss is 10%. This sounds easy, right? But let me explain to you why this is, for me the biggest con, here you need to have a minimum of one trade every two days, since in 30 days you have twenty working days and the market does not always have good volatility, so it is going to be hard for new traders to pass these kinds of challenges.

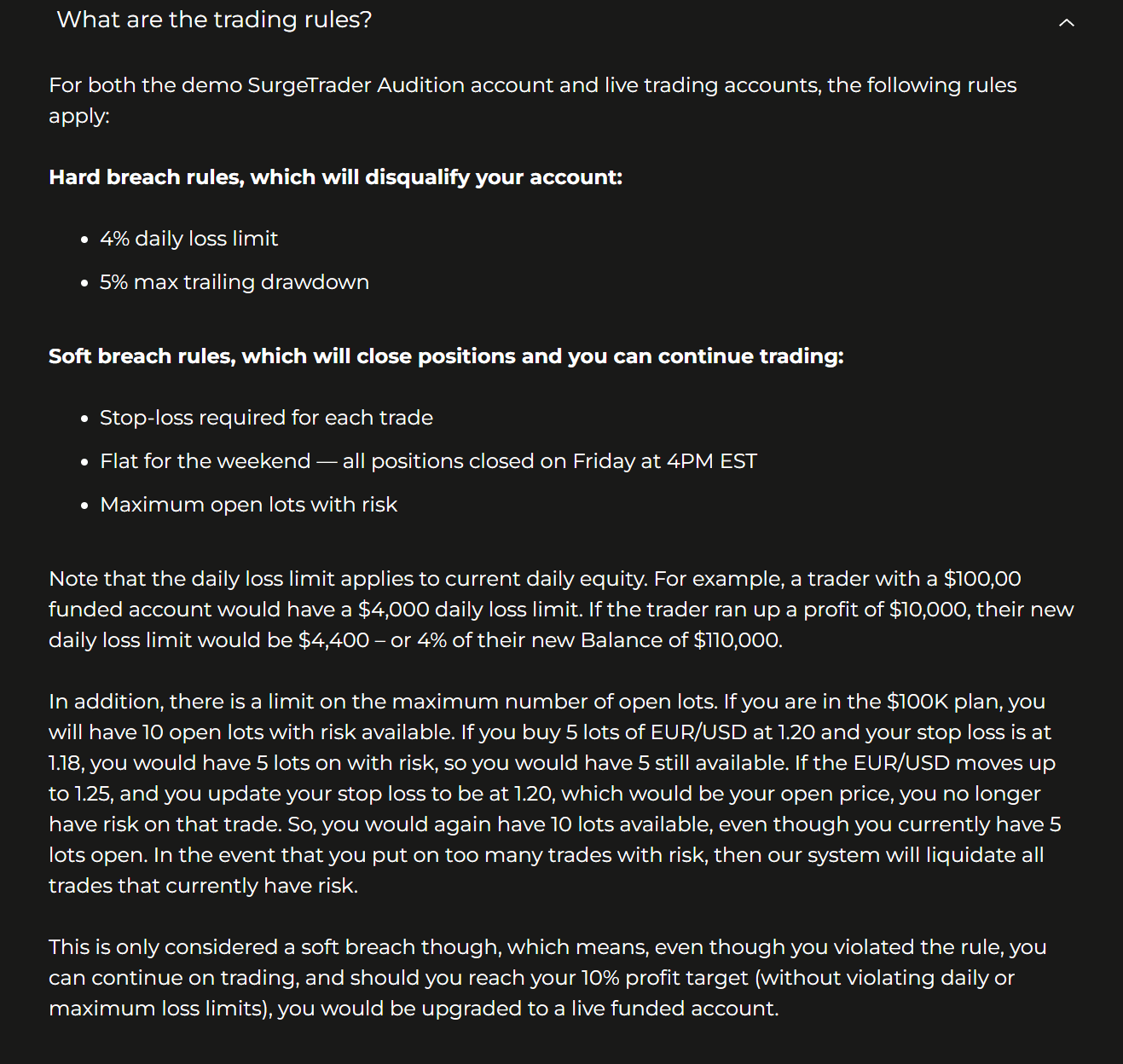

Example Surge Trader

The second option is similar, you have 4% daily loss and 5% as max risk, and all positions must be flat for the weekend. Now this may sound strange, but you don’t have to worry about how long it’s going to take to pass. You are not forced to trade when the market is in a Low Volatility mood, so I would be ok with these conditions.

Every Prop fund has specific rules that you need to follow. I would strongly suggest that you read everything and test for a week on your account to understand how everything works before you decide you’re ready. Most Prop Funds will have a time limit. It would be best if you did not waste that and be forced to open bad trades later.

Quick Tip For Passing The Audition Stage Fast!

Before you start this, make sure to check if the Prop allows a trade copier, 50% of them will enable you to copy your trades from your main account and use a copier! In my experience, if you trade your live account and use a copier, it will be much easier (you do not focus on the Prop, you focus on trading one account). The easiest way to get to 10% in a month would be simple pattern trading, do not test crazy indicators or news, play safe, and you should be good to go about passing later in the post.

Con #3 Closing Position At The end of Day/Week

Most Props have a rule that you should be FLAT when trading days or weekends. This can be great if you are day trading, but this will be a big problem for everyone who likes swing trading. We can understand that they are trying to protect their capital when you sleep, but this can limit your preference if you are not used to that kind of trading. For me, this is not a big deal. I’ll be flat in any case, but this can be a problem for others, so make sure your best trading strategy fits with this rule.

Con #4 Not Suitable for Everyone

Working with over 5,000 students in recent years has told me that not everyone can manage other people’s money. This will be the biggest factor in your journey to trading with prop money. It is much less stressful to trade with Prop funds than trade for other people here. You do not have to have any contact with people whose money you manage.

I tried a few solutions with my students, and the only thing that worked was the copier! If you set up a trade copier on a VPS and focus on trading, your money pressure is gone, and you can pass this. The important part is that you do not check that prop platform all the time. Just check once per Day if the copier is active, and that is all. If that does not work, I would pass on this idea in general since there is no point in trying to achieve something while not stress-free.

Con #5 Rules That You Must Reach 10%

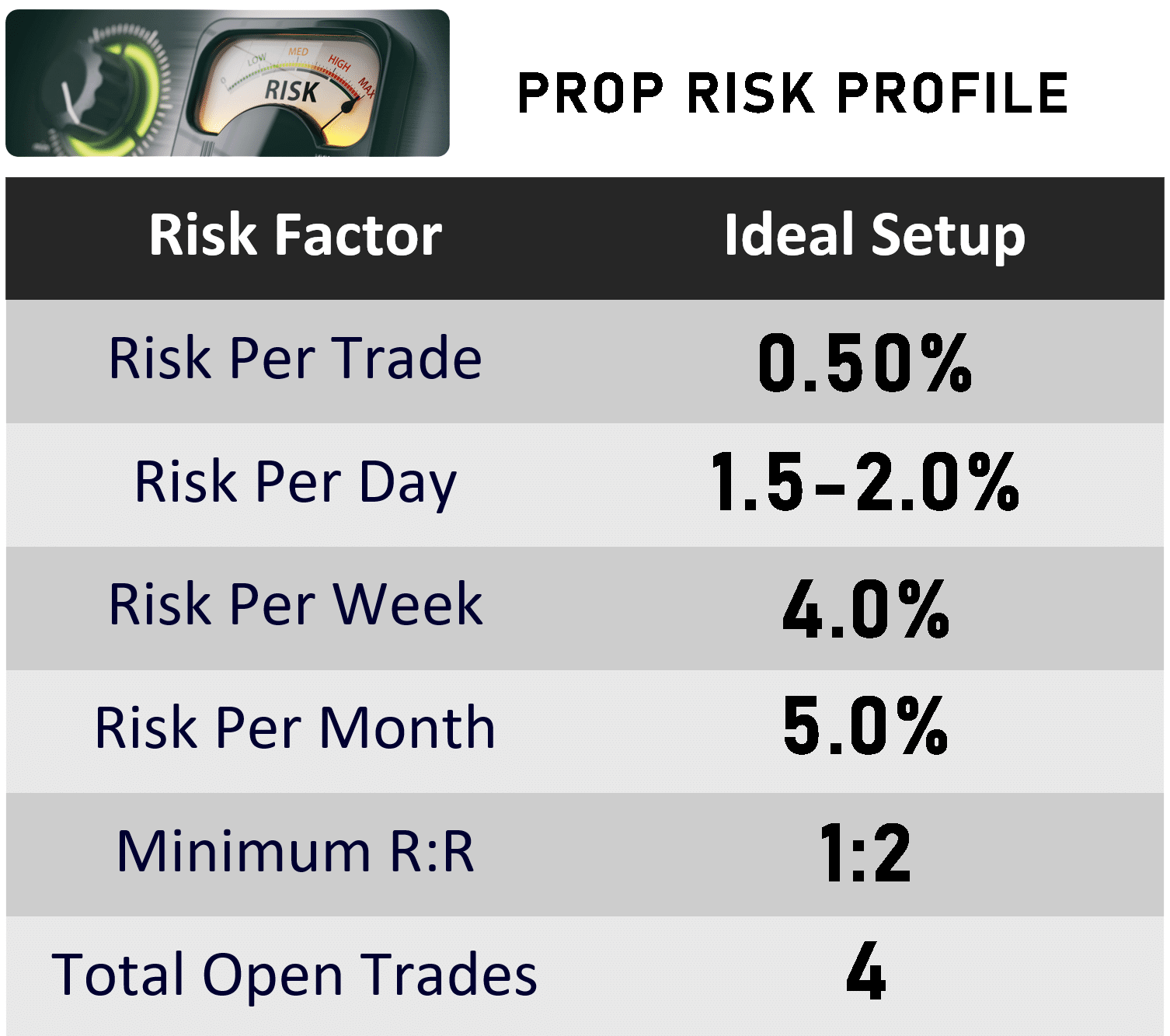

Every Prop has a target level for you to reach, and only once you achieve the goal will they send you money. Let us go with a most common target of 10%. This sounds easy in your head, most of you make 20-30% on your accounts, and you think this will be achievable until you start trading. Trading for Prop Funds will force you to use less leverage, and with max risk, your average risk per trade should be around 0.30-0.50%, so to reach the target, you will need between 30-40 trades per month (with a good win rate strategy). I do not have an issue with this kind of rule since I had a similar risk profile working for banks and funds the majority of my time, but you should be fully be aware of that!

Quick Tip: Check your trading history in the last 90 days, and only if you have more than twenty-five trades (40 ideal) think about using a prop to build your capital faster..

Step #3 Understand How to Select The Right Prop For You

When I started to use prop funds eight years ago, you only had two or three options, so you were locked if you wanted to go this way for getting capital for trading. In recent years, many companies have been offering funded accounts. Over 50% of them are SCAMS, and they want you to pay for the audition! Let us go now and talk about things that can help you select the correct prop fund for you.

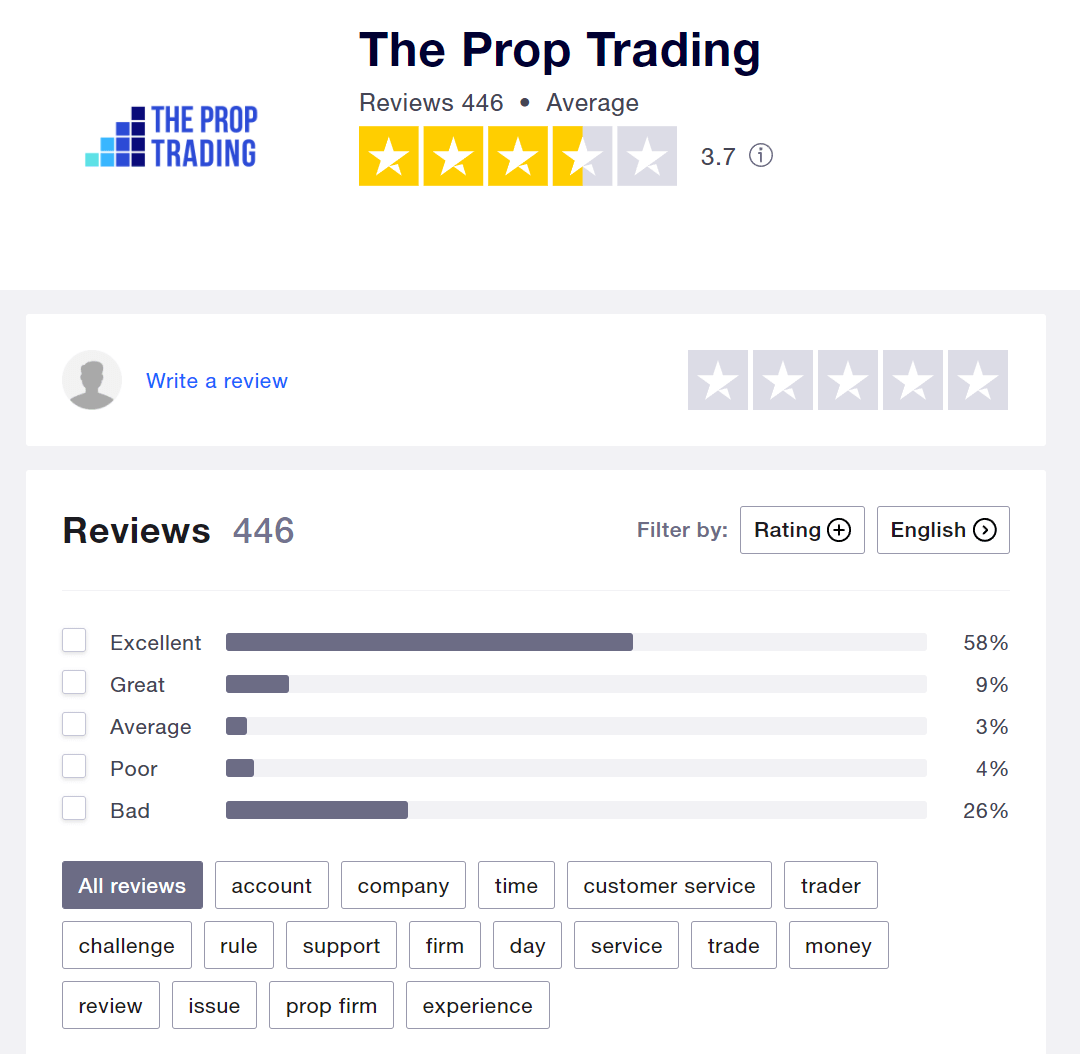

Check For Reviews

This is a relatively easy part. You can go to the Trustpilot website and search for opinions. Make sure to understand that there are always going to be stupid reviews from people who have never traded, but if you read a few of what people say, it is going to be easy to understand if something is legit or not.

Check Rules

Go over all the rules on the website and make sure you read everything carefully. Things I prefer to check are Active Trading Days, Max Risk, Trading Around News, EA Allowed, Platform, Broker… Only if you think that you can fit everything in your trading strategy can you move on.

Talk With Prop

It is important to contact people with who you are going to work. This is normal in any business here. Your goal is to see if they are more oriented to traders or to marketing. If they are more marketing-oriented and people behind the fund never traded, just skip them (When the marketing team builds a fund, they do not understand what you need). In my experience, 20% of props that are active now are here for you, to help you earn, while 80% of them just want you to pay them audition, and that’s all (statistics say that 95% of new traders will lose an account in 90 days, so you see why this can be lucrative business).

Quick Story: Last year I had a meeting with one Prop, “Funding Talent” after the first 5 minutes, I knew they were a marketing agency, they told me we want traders that can trade, but when you talk about the market, you learn that the person behind the fund never actually traded! After 30 minutes, they explained to me that they do not have one trader that is on a live account and that they made 1M. I was shocked, pissed off, and knew that I couldn’t recommend them to any of my students. A year later, they are gone, that is why it is crucial to pay attention to small details 😊

When you find a prop that passes all three things, you are good to start your application process.

Step #4 Best Approach For Trading With Prop Funds Capital

Now it is time to discuss trading strategies that work for this kind of trading. The first and most important part will be the number of trades your system generates. To be sure you can pass your 10% goal per month, we will focus on day trading systems that generate between 50-100 trades per month. To make sure you do not waste time with all instruments available for trading, you should be focused on instruments with higher volatility.

Step #5 Prepare Yourself To Pass Audition Fast

We already talked about strategies that work. Now let us see what the easiest way to pass your audition stage is. Because some funds have rules that you need to have 50-100 trades before they give you an account, the easiest way to pull that out would be to focus on technical patterns on smaller time frames like M5 (aggressive approach) or M15 (better approach) and go with a trend. This option has never failed so far.

For me personally, the two easiest patterns for this kind of trading are triangles & flags. They are both trend continuation formations and give you a chance to get between 1:2 – 1: 3 risk-reward. Just make sure you have only one target. With tight risk settings, we need to follow usually it is better to go straight towards TP without partially closing the trades.

The key in this stage is to prove to fund that your risk management skills are good enough, so I am suggesting the following risk profile:For me personally, the two easiest patterns for this kind of trading are triangles & flags. They are both trend continuation formations and give you a chance to get between 1:2 – 1: 3 risk-reward. Just make sure you have only one target. With tight risk settings, we need to follow usually it is better to go straight towards TP without partially closing the trades.

If you go this route and try focusing on patterns to get funding, the best thing can be some indicator or service that helps you find formations all Day long.

Quick Tip: In 2022, you should be allowed to use the copier, so if you combine your trading and patterns, this will be done in no time.

Step #6 Keep Grinding Your Way Up

Now here comes the interesting part, once you get your funding account, the journey really starts, you have the real account, and after 30 days, your first salary as a “real trader.”

Try to keep your trading the same as you have been doing till that point, do not try to make millions in one month or do stupid things like that. You worked hard, passed the audition, and it’s now time to relax. At the beginning, you won’t see large numbers at month-end, but it’s usually 2-3k extra.

You have two options, one to enjoy and spend that money or what I suggest is to take 30% for spending and 70% move to your trading account. This way, your trading account will reach 15-20k per year, and more profit you will generally earn.

I was doing this until I reached 20k on my account, and after that, it was much easier since your account has better leverage, and if you learn how to consistently make 10% per month on prop accounts, this can easily be 20-30% return on your account. Now you get the point of why this is important.

IMPORTANT TO KNOW: Every fund I ever tried will keep rewarding if you consistently make a profit. Usually, after 90 days, you will get a call, and they will tell you to expect more money on your prop account. This part, for me, is the best feeling you can ever achieve since that’s just recognition you are good at something. Do not worry if, on the website, you do not see the potential for growth or things like that. It is all BS. They know from the start that only a few percent of people can make money, so they will reward you if you prove that you deserve the spot.

Bonus: What Prop Fund I Use Right Now In 2022 & My Honest Opinion About Them

After eight years of using this kind of funding solution, I still love it; people often ask me why and my answer is always the same “it’s free money, why not.” Don’t get me wrong, I don’t need to trade other people’s money to have a decent profit, but getting an extra 10-15k per month without extra work is something I won’t say no to. Everything is done with copiers.

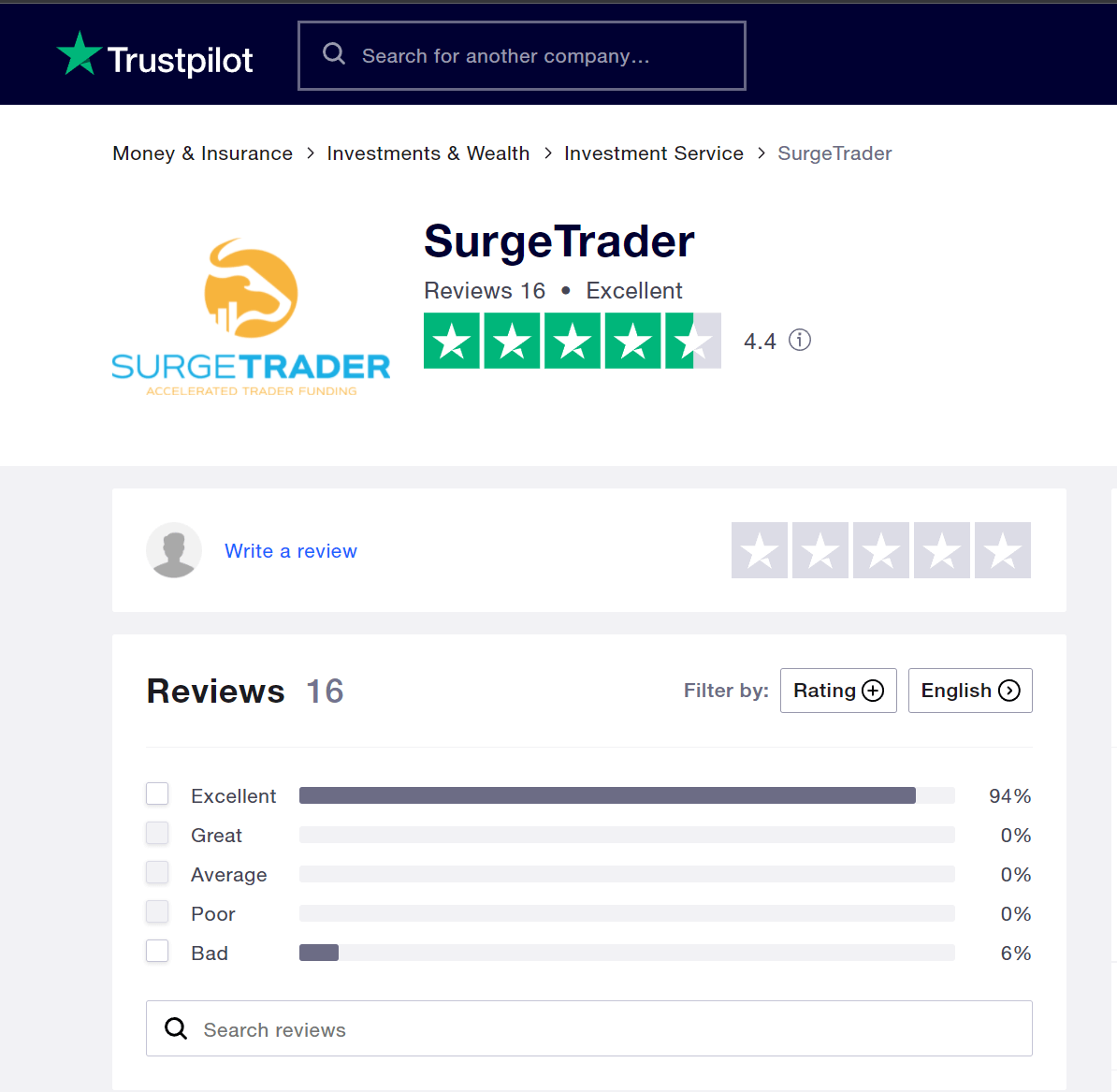

The main Proprietary Fund I used in 2022 is Surge Trader. It is a reasonably new prop I’ve added into my arsenal just a couple of months back, and for now, I’m more than happy with them. That is one of the funds created by traders for traders.

The rules are simple, with not many things you need to worry about, one downside is FLAT over the weekend, but I am mostly a day-trader, so for my style of trading, they work better than others, and a big plus is that I can use all my tools without a problem.

Conclusion About Prop Trading

Trading with Props has ups and downs, as you figured out by reading this small guide, but overall, it’s the fastest way to grow up your trading account in 2022. I can say that trading with these kinds of funds pushed my trading to the next level. I got my discipline and rules from them, so if you think this is something you were looking for, go for that!

Regards,

Nicola

PS If you have good or bad experiences with prop funds, feel free to share them with me and others in the comment section down below.

Great info, you’ve answered some questions I had for prop firm trading accounts. I know you mentioned chart pattern trading but I was wondering if these challenges can also be passed with Trade juice?

Hi Jesus, i wanted this to be educational article not for me to promote my products, but i like that challenge, we will try to record me passing any fund test for prop just with trade juice 🙂

That sounds awesome!! It would literally be a life changer if we could successfully utilize Trade Juice for prop firm trading!! Soooo exciting!!

Very crucial and valuable information this Nicola Well laid out plan with some great tips

I’m glad that you enjoyed article.

Very good actionable information

Thanks for a kind words 🙂

Do you have any articles on which copy traders and strategies would work best? I am currently taking the surge trader 25k audition and need some assistance. My aggressive trading style hasn’t boded well for this challenge so far .

Hi Kenneth, let me tell you what Surge or any other Prop wants to see on your account. All Props wish to see your trading; they all want to see between 50-100 trades and a slightly tighter risk system. Try to have between 0.50-1% for Risk per trade and look for a minimum 1:3 Risk Reward. I suggest you go for some trend trading system, anything that can generate 50-100 trades per month, and you should be good to go.

It’s important to understand that Copy trading is against every prop company’s rules, so you shouldn’t use copiers or copy other people’s trade. Prop gives you money to generate your ideas; this way, they diversify Risk.

Regards,

Nicola

I’ve been a prop trader for the last few years and that’s what keeps me going. Small balance = small profit!

Exactly, i don’t say this is the best way, but when you check pros and cons of using props, it’s more than ok