Getting to “Successful Trader” status is the primary goal of a new or young trader. Everyone wants to get to the level where they can be profitable month after month and enjoy their life.

After 13 years in the trading world, I’ve had the opportunity to work with many great traders. I tried to learn something that could help me in my journey from each trader I met. Everyone was helpful, and I’m more than grateful for that.

I bet you think that successful traders have some “secret” tools that help them, but that’s not true. Every successful trader just does a few things slightly Different Than You. Today, I Would Like To Share The Top 8 Things Successful Traders Do Differently!

Difference #1 – Successful Traders Admit When They Are Wrong

The one thing I could spot right away is this: it’s hard to admit that you are wrong. If you followed your plan and placed a trade, everything tells you that you are trading on the right side of the market.

But if something goes wrong, most traders start to panic and don’t want to admit that maybe they missed something. 8/10 times when I check my losing trades, I realized that my checklist wasn’t completed correctly.

Mostly inexperienced traders will try to hold positions for more extended periods. Or even worse, they will try to increase size. This is something a lot of “gurus” and “influencers” show online. So, someone who didn’t get a quality trading education would copy them, and the result would be a disaster.

It would help if you started changing that part. Once you get a clue that maybe your original ideal is wrong, just cut the position and wait for better ones. Don’t try adding or waiting a few more minutes. In trading, you need to go with the approach, “No emotions when you trade, and tomorrow is a new day, a new opportunity.”

Difference #2 – Successful Traders Always Have Trading Plan

When you ask a successful trader about a trade they took, they will tell you in the smallest detail why they have it in their portfolio. Asking hundreds of traders who have not been profitable the same question, you would be lucky if three percent could give you a good reason why they are in the trade.

Most people don’t have what we call a “trading plan.” That’s one of the things that can separate you from losing your circle.

Everything I’ve learned so far in my trading career tells me that most successful traders use some sort of mechanical system. Using a mechanical system ensures you can make a simple checklist that will help you grade your ideas and only take ones that pass all your criteria.

So, the second most significant difference between successful traders and everyone else is a good trading plan. Don’t even think about becoming a profitable trader without making the plan to help you in this journey.

Difference #3 – Successful Traders Commit To Their Goals

When you start researching successful people in general, you realize that everyone had a goal to be successful! Look at your friends you went to school with: remember how many of them wanted to become engineers, architects, doctors… And now think how many of them accomplished that goal. In my experience, only a small number of people, one or two percent, will stick and commit to their goals.

The big difference between you and successful traders is that they have a list of goals they will try to achieve. Try to have your trading goals printed and close to you, so you always remind yourself that you need to work hard.

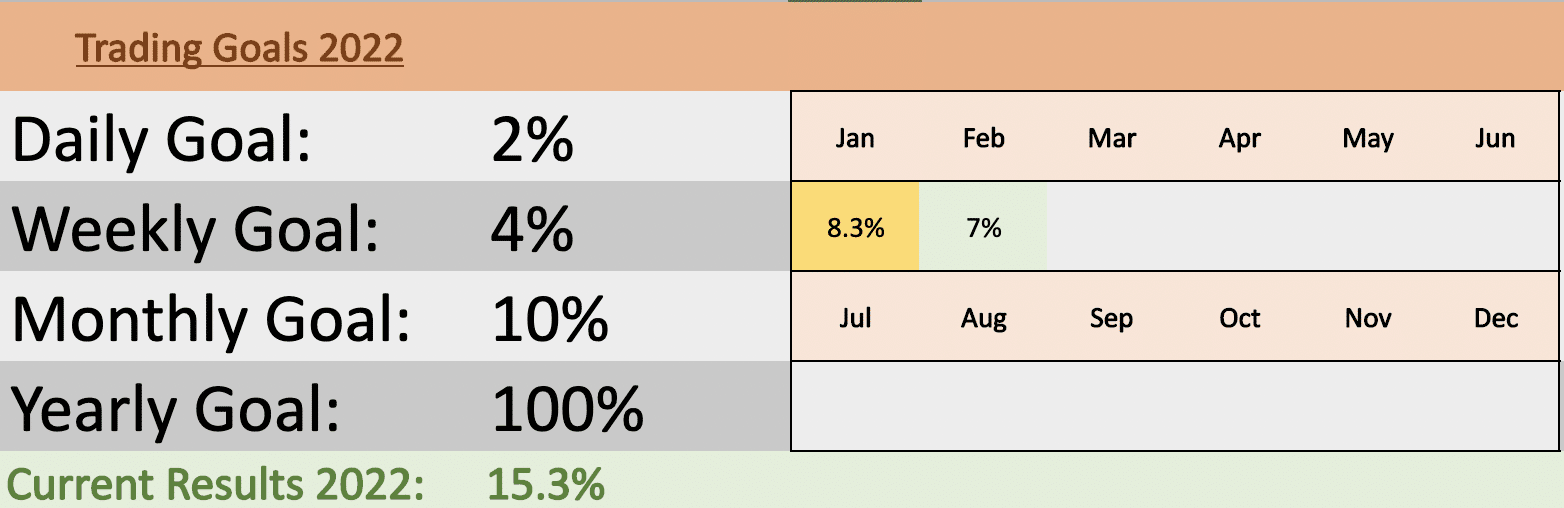

Here is my trading goal for this year.

As you can see, it’s not something that’s difficult to do. What I have is this: ideal daily target, a weekly target, monthly target, yearly target, and a few other items. Feel free to copy this or tweak it according to your desire.

Goals help with motivation: once you reach the goal, you will be proud of yourself, and you’ll know that you can reach that goal again and again.

Quick Tip: When we are talking about trading goals, I suggest starting with smaller and achievable targets. As I said, the sooner you reach your goal, it’s going to be easier to relax and trust your trading. So start with a goal like $100 per week, and once you reach it three times, feel free to move it to $150 or $200 per week.

Goals help with motivation: once you reach the goal, you will be proud of yourself, and you’ll know that you can reach that goal again and again.

Quick Tip:When we are talking about trading goals, I suggest starting with smaller and achievable targets. As I said, the sooner you reach your goal, it’s going to be easier to relax and trust your trading. So start with a goal like $100 per week, and once you reach it three times, feel free to move it to $150 or $200 per week.

Difference #4 – Successful Traders Take Responsibility For Every Loss

Traders know that the chance of having a 100% win rate is next to impossible. Don’t get me wrong, every trader I talked with would love to have something that just makes money on every single transaction. The reality is different: most successful traders are going to be happy with a strategy that has a 60-70% win rate.

This was important for me to clarify another of the biggest differences between successful traders and everyone else is how they handle the loss.

Unexperienced traders have a big issue when it comes to losing. Due to the size of the positions (in most cases), traders start to blame others. They start with brokers. “My broker is cheating me, and they are hunting my stop.”

I bet you had this thought at least once or maybe, “Hedge Funds are moving the markets” or “Bloomberg analyst said the market should move higher.”

It would help if you saw this from the professional side. You are the person who placed the trade. If your trade didn’t do what you expected, go and re-check your plan: see if you missed something important. This way, you will prevent the same mistakes from happening over and over again, If everything is fine, move on and focus on the next play.

“You can’t do anything with the trade that’s closed. Stop wasting time on finding excuses and find the next setup.”

Difference #5 – Successful Traders Work Hard

Social media and marketing agencies put the idea that you can party 24 hours a day while your hard-earned money is going to double every month. This is what people think in 2022. Trust me, I talk with a lot of new traders daily, and 9/10 people come to me to make millions in the next 30 days.

Let’s be clear. I’m sure that you can turn $1,000 in to $10 000 in a month, especially if we consider leverage and cryptocurrencies. Still, I wouldn’t be able to promise that it would be accessible or achievable to everybody. If I try this kind of challenge every month till the end of the year, I will maybe make it two or three times the cash and blow the account nine or ten times.

The next part that successful traders do differently is working hard. It will take a minimum of an hour or two every day to prepare your watch list and another two to trade. So the minimum I would say that you need to work would be four hours every day if you want to be a successful trader.

This part will be individual to everyone since each person has a different strategy and style of trading. Just make sure if you want to be a successful trader, you try to have a minimum of two hours every day to work on your portfolio.

Difference #6 – Successful Traders Talk With Other Successful Traders

You probably already heard this quote, “You are the sum of the five people you spend the most time with.” When I started to analyze when my trading changed drastically, it was the time when I got a job in a hedge fund. Thinking back now, it was the time when I spent most of my hours talking with other traders and getting other people’s views of the market.

The majority of traders like to talk about the market, share views, and try to discover if they found all tiny details about the instrument they are planning to trade.

This part, for me, can be good and bad for new traders. Let me give you all the details, so you can decide if you are going to do this or not. As mentioned earlier, the goal is to network with like-minded people and find someone with who you are going to share ideas, talk about the market in general, and that’s all. Your trades should still come just from your game plan, not someone else’s, and you should try to keep your circle small: 2-3 people max.

Important: Don’t fall into the guru chatroom situation. I’m talking about chat rooms full of new traders sharing opinions and charts about the same instrument. In this kind of scenario, most people get confused. They see 50 traders favoring long while the other 50 are calling for short plays. You don’t know who to trust. Just think about this: if you have 100 traders who are not successful, how could you expect to learn something? So, I’m highly in favor of avoiding this kind of solution and going with a few people to share with. Or, skip this part entirely…

Difference #7 – Successful Traders Don’t Show Emotions

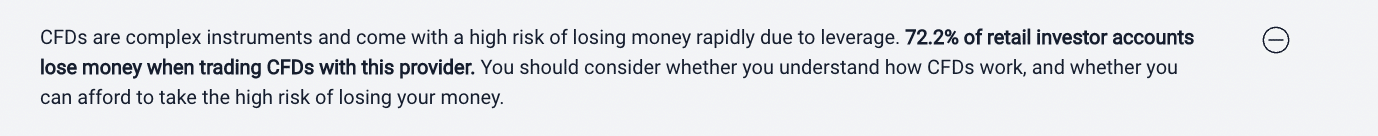

When you start looking at stats from the brokers, that looks like this

Where it says that for this broker, 72.2% of clients lose money, you start to ask yourself why. Working with over 5,000 students showed me that most new traders fail to control their emotions.

Emotions really play a crucial role in trading. At the end of the day, if you learn how to manage your feelings, it will be a good week. It’s that simple.

You need to start to treat trading Currencies, Stocks, or any other market as any other job in the world. You already know that you can’t be successful in business if you start following your emotions.

Every time I spend more than 15 minutes with a member, I can tell you right away how much they need to become profitable. My estimates seem too much for many people, but over 90% of the time, I am right to the point. I firmly believe that everyone can learn how to trade, but what’s going to determine how successful they become is that moving part.

Let’s take a look at one example that everyone can relate to: imagine working with your sister or best friend. They are not working as much as you expected. Are you going to sit down and say, “Keep doing what you are doing,” or you will tell them, “Listen, we know each other, but you are not giving your best, and you think I won’t fire you because we know each other.”

It’s the same in trading. This is a job just like any other. Whether you win or lose, it’s the same. You need to stay cool and try to give your best every single day.

We have a lot of reasons why people have problems with emotions, but one of the biggest reasons I have seen so far is wrong sizing. Traders try to take larger risks than they are comfortable with. You can watch my video on that subject below, so I don’t make this blog post into a book.

Difference #8 – Successful Traders Constantly Learn More

The trading game is changing every year. What used to work last year doesn’t necessarily work this year. When you start analyzing the top traders in the world, you will get that they constantly aim to learn more about the market and improve their “A-Game.”

If you want to be a phenomenal trader, you should follow this rule: try to learn something new about trading every couple of months. This can be from a book, or a class, it doesn’t matter. Just try to learn something about trading that you don’t know before and see how you can implement your new knowledge into your trading game plan.

Just one small but important thing about this. Try to master one thing at a time. This means if you start to learn, let’s say, technical chart patterns, work on that part until you are sure that you can spot them all day long without the help of any tools. And after you master them, move on and learn something new.

This is one of the things that will most help you. I’ve personally have been on five different seminars and classes on trading automation in 2021. So far in 2022, I’ve attended two fundamental class by my old college and friend. This is just to give you an example that even though I’ve been profitable for over 12 years, I still try to learn more every year.

Conclusion About What Successful Traders Do Differently

I think that you now see that we didn’t mention anything about some “secret” tools that separate you from reaching that “successful traders club.” All of the strategies I have mentioned in this short article are something that you can do on your own, without much trouble.

We can talk about more minor things that you need to change, but this should be enough to improve your trading for now. If you have any advice for new traders, feel free to share it in the comment section below.

Regards,

Nicola

Thanks Nicola. I have problem with the discipline

Mr Delic when are you making a video or blog on order blocks ict

Hi Pontsho, supply and demand is always a good and interesting subject, i’ll try to make a video in the next two weeks.